Hi blog readers! I thought I would have some and share my Top 6 Favorite Real Estate Themed movies! Part 1.

What’s your favorite movie?

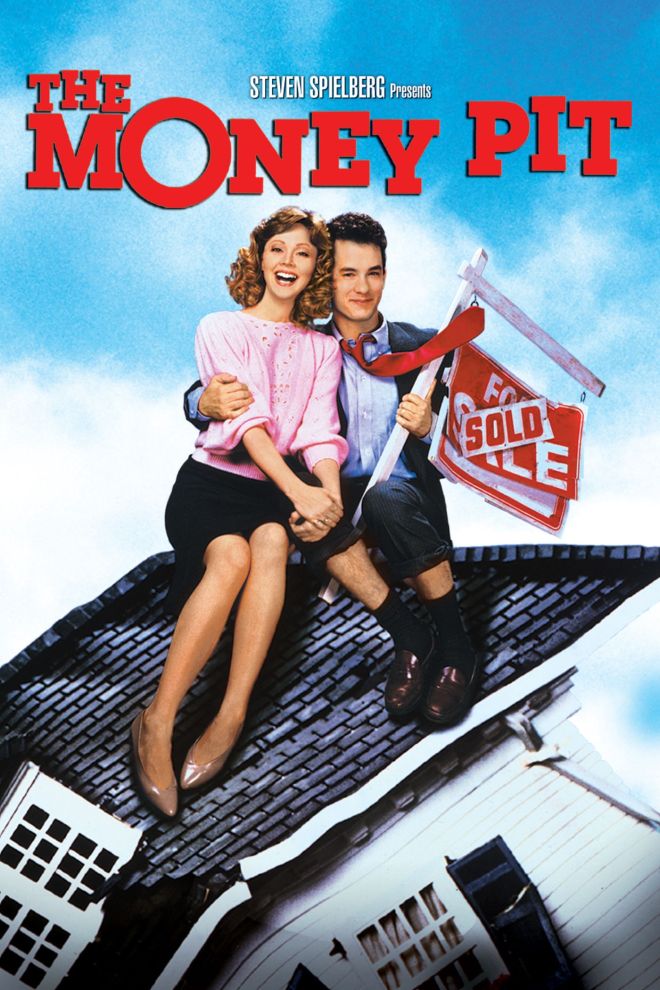

Number 6

The Money Pit – 1986

Tom Hanks, Shelley Long – Directed by Richard Benjamin. Written by David Giler.

This was an easy choice, buyer beware! A classic, worth a good laugh and some consideration if you’re looking at fixer uppers.

Number 5

Back to the Future 2 – 1985

Michael J. Fox, Christopher Lloyd, Lea Thompson – Directed by Robert Zemeckis. Written by Robert Zemeckis, Baby Gale

The reason I selected this classic time travel tale is for the exact moment Marty is standing at the Lyon Estates Entrance and his street is still farmland. That sparked my love of history and real estate and as a little girl, I started looking into the history of San Carlos – which started off just like that. Stay tuned for my History of San Carlos bit coming soon!

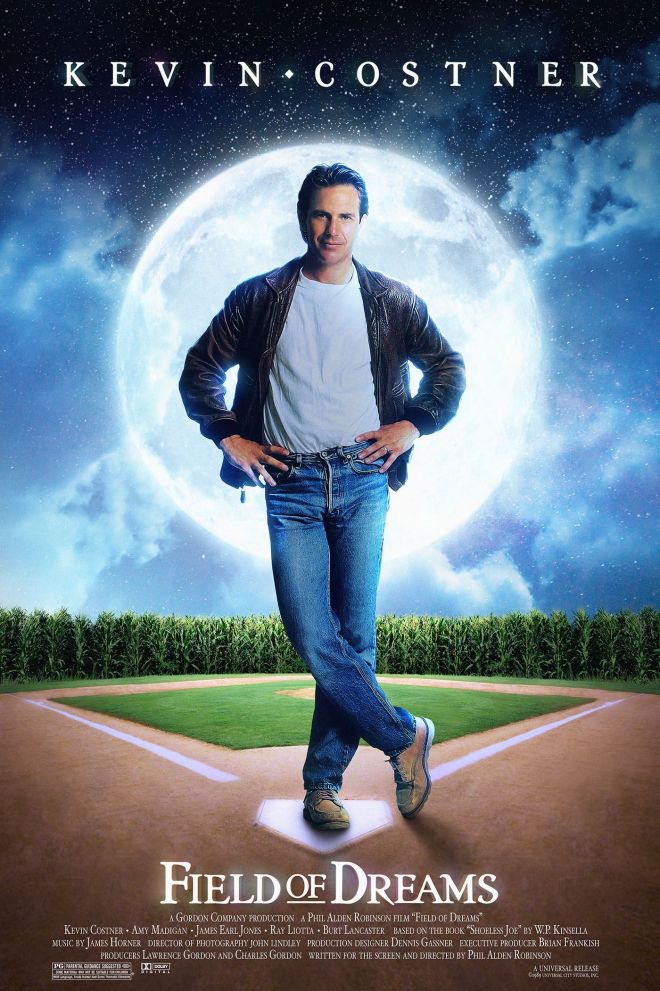

Number 4

Field of Dreams – 1989

Kevin “Dances with Wolves” Costner, James Earl Jones, Ray Liotta – Directed by Phil Alden Robinson – Written by W.P. Kinsella and Phil Alden Robinson

I had to choose this movie – as in the options when you are a homeowner – as in – you turn your cornfield into a Field of Dreams. The message is clear, homeownership allows for your dreams to come true – whatever they may be. Super cheesy – however I just love Kevin Costner and baseball so I had to pick this!

Number 3

Home Alone – 1990

Macaulay Culkin, Joe Pesci – Directed by Chris Columbus – Written by John Hughes

Now, this is one of my childhood favorite holiday movies but what I really fell in love with was the house. Did you know the entire home was decorated in Christmas colors – red, green and white? That beautiful colonial home will always be Christmas to me.

Number 2

Mr Blandings Builds His Dream House – 1948

Cary Grand and Myrna Loy – Directed by H.C. Potter – Written by Eric Hodgins, Norman Panama

A true classic film starting Cary Grant (swoon) and Myrna Loy (Gorgeous). I love every aspect of this film. Each headache Mr. Blandings experiences is as true today as then. A great movie just to laugh through your own remodel.

Number 1

Under the Tuscan Sun – 2003

Diane Lane and Raoul Bova Realtor Vincent Riotta – Directed by Audrey Wells – Written by Frances Mayes, Audrey Wells

First I love Diane Lane. Who doesn’t. She is divine in this role and so is Bramasole. Another home that just beckons to me. But Martini, the Realtor played by Vincent Riotta is just perfection. The whole movie is a feel good moment. I love the theme of turning a house into a home, and again how dreams really do come true.

Thank you for following my favorite Real Estate themed films.

What are some of yours?

Got Questions – The Caton Team is here to help.

We strive to be more than just Realtors – we are also your home resource. If you have any real estate questions, concerns, need a referral or some guidance – we are here for you. Contact us at your convenience – we are but a call, text or click away!

The Caton Team believes, in order to be successful in the San Fransisco | Peninsula | Bay Area | Silicon Valley Real Estate Market we have to think and act differently. We do this by positioning our clients in the strongest light, representing them with the upmost integrity, while strategically maneuvering through negotiations and contracts. Together we make dreams come true.

A mother and daughter-in-law team with over 40 years of combined, local Real Estate experience and knowledge – would’t you like The Caton Team to represent you? Let us know how we can be of service. Contact us any time.

Email Sabrina & Susan at: Info@TheCatonTeam.com

Cell: 650-799-4333

The Caton Team – Susan & Sabrina

A Family of Realtors

Effective. Efficient. Responsive.

What can we do for you?

The Caton Team Blog – The Real Estate Beat

How to Buy While Selling Real Estate

Want Real Estate Info on the Go? Download our FREE Real Estate App: Mobile Real Estate by The Caton Team

Visit us at: Our Blog * TheCatonTeam.com * Facebook * Instagram * LinkedIN Sabrina

Thanks for reading – Sabrina

Berkshire Hathaway HomeServices – Drysdale Properties

Sabrina DRE# 01413526 / Susan DRE #01238225 / Team DRE# 70000218/ Office DRE #01499008

The Caton Team does not receive compensation for any posts. Information is deemed reliable but not guaranteed. Third party information not verified.

You must be logged in to post a comment.